Live Gold, Silver and Platinum Spot Price

Historical Platinum Spot Prices

Live Platinum Price Chart |

Platinum Price Per Ounce

OneGold's Platinum price chart shows real-time data for silver prices today and the historical price of platinum per ounce. Platinum prices may be viewed for any date within the last 30 years in the interactive chart below. Simply click on the date range to view platinum price movements for that time period. You can also hover your mouse over the platinum prices chart to see the specific price of platinum for each day.

| Live Platinum Price | Platinum Price Today | Platinum Change |

|---|---|---|

| $929.30 | $3.80 | |

| $29.88 | $0.12 | |

| $29,877.67 | $122.17 |

Platinum is a critical metal for the health and wealth of the world. It's one of the rarest metals in the world with unique physical and catalytic properties making it highly valued across a number of diverse demand segments.

About Platinum Metal

Qualities of Platinum

The melting point of platinum is 3,215 °F (1,768.4 °C) and the boiling point is 6,917 °F (3,825 °C) and the least reactive metal known to man.

Platinum is ductile, meaning it can be pounded into a sheet which is as thin as 100 atoms. One gram of platinum can be stretched into a wire that is over 2,000 meters (over a mile) long.

Platinum is one of the heaviest metals. A six-inch cube of platinum weighs as much as an average human being. And it's also one of the densest elements. Pure platinum's density is 21.45 grams per cubic centimeter.

Platinum is the only material suitable for the electrodes required in the 600,000 heart pacemakers which are implanted each year.

Quick Platinum Facts

Meteorites and our moon contain a higher percentage of platinum than can be found on the Earth.

The metric kilogram is still officially defined by a platinum-iridium cylinder made in 1879 which is held in Washington D.C. at the Bureau of Standards.

During World War II, non-military use of platinum was banned in the United States, as it was deemed a strategic metal.

The world's largest deposit of platinum is in the Merensky Reef in the Bushveld Complex, South Africa.

Four ways Platinum helps our world

Manufacturing – from fertilizer, fiberglass and lightbulbs to airbags, and sticky notes, industrial demand for platinum has increased nearly 4x since 1980.

Healthcare – from medical devices and cancer treatments, platinum is a biologically compatible metal because its not toxic, and stable. It does not react with or negatively effect body tissue. Platinum compounds such as cisplatin damage cancer cells, and can treat specific cancers including testicular, ovarian, lung, bladder and head and neck cancers.

Environmental – from harnessing renewable energy and reducing vehicle emissions, Platinum's properties make it critical to reducing air pollution and in the construction of energy efficient fiberglass.

Renewable Power – fuel cell electric vehicles use platinum's catalytic property in the electrolysis of water in the production of hydrogen, and as an ideal surface for the Proton Exchange Membrane "PEM", used in a growing number of electric vehicles.

What is the spot price of platinum?

The spot price of platinum is the price you would pay for one ounce of platinum on any given day. Measured in troy ounces, the value of platinum is determined in comparison to its metal content. The spot price varies based on the world market exchanges, placing heavy importance on researching current performance indicators, including current events and market conditions, as they influence both buying and selling of platinum worldwide.

Platinum Supply and Demand

Platinum is 30x rarer than gold. All the platinum ever produced would only cover your ankles in one Olympic sized swimming pool. All the gold ever produced would fill three Olympic sized swimming pools.

Twice as much steel is poured in the United States in only one day than the total world's platinum production in one year.

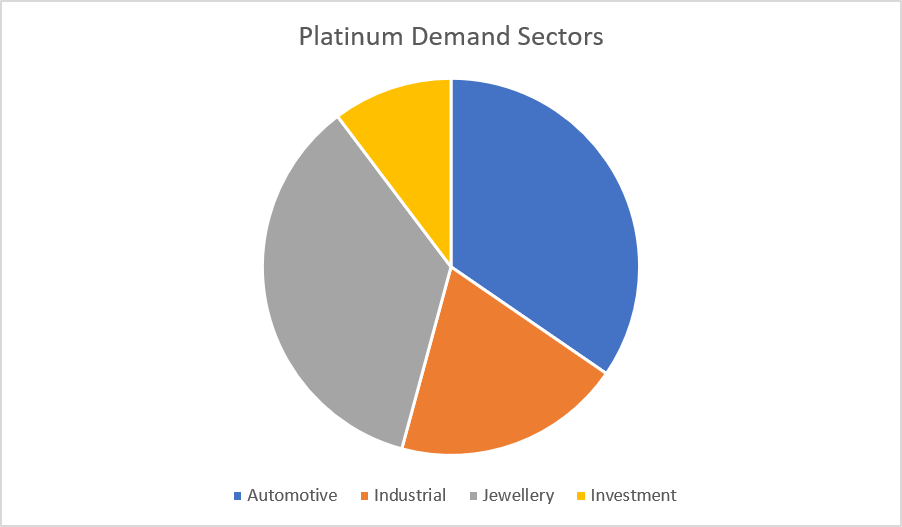

Four core segments of platinum demand.

Automotive 37 - 41%

Industrial 18 -21%

Jewelery 31-38%

Investment 2-11%

Automotive

Platinum is central to reducing vehicle emissions both now and long term. It's used in spark plugs, catalytic converters, supports diesel fuel efficiency and in hydrogen fuel cells, and electric cars.

Industrial

Platinum catalyst increase yield in chemical processes and results in higher octane fuel per barrel. It also is used as a high-density storage on hard drives and supports cloud storage technology. Platinum also supports electronic equipment, monitors and healthcare devices such as pacemakers.

Jewelry

China is the world's largest market for platinum jewelry, representing well over half of the annual demand. In the US, platinum is the number one choice for engagement rings

Investment

Platinum is growing year over year as an investment vehicle of choice for many investors. It's represented in bullion coins and bars from the world's mint, and exchange traded funds (ETFs) are firmly established on many exchanges.

Platinum Spot Price FAQs

How is the spot price of platinum calulated?

OneGold uses the Chicago Mercantile Exchange (CME) Platinum futures and adds an exchange for physical (EFP) when determining the current spot price. Many precious metals wholesalers and retailers use this process. The price of the platinum futures contract is the price of platinum for delivery at the end of a given month. The EFP adjusts the futures price to the price of platinum for immediately delivery. Each day, OneGold works with several top wholesalers to get in alignment on the EFP.

We typically use the futures contract with the highest volume. Please follow this link on the CME for the most actively traded platinum futures contracts.

Does platinum only trade in U.S. dollars?

No. With OneGold, you can create an account and designate the currency that you wish to use. During the sign-up process, you can select between USD, CAD, EUR, and GBP. You can transact using any of these currencies. Additionally, your OneGold account, including the price of platinum, will be denominated in the currency that you select.

What influences the price of platinum?

The price of platinum is driven by a variety of factors. These include but are not limited to, supply and demand dynamics, geopolitical events, and economic conditions. Given platinum is used heavily in industry, developments in the automotive sector have also historically driven the price of platinum.

How do I buy platinum?

You can buy platinum in a variety of forms. With OneGold, you can buy physical platinum stored in a secure vault. When buying platinum through OneGold, your metal is insured and undergoes regular, third-party audits. To buy platinum from OneGold, simply create an account and order as much or as little as you want, with just a few clicks.

Platinum Market News

Latest markets news on precious metals